up to $2000

With inflation rising and markets unstable, learning how to invest in gold in India is more crucial than ever.

Whether you're a complete beginner or an experienced investor looking to diversify your portfolio, this guide covers everything from physical gold to leveraged gold trading, helping you make informed decisions about gold investment that maximize your returns while protecting your wealth.

up to $2000

up to $1100

$1500 in 5 Hours

Make $950 To $2200 Daily

$50 sign-up bonus

100%

100%

10%

$30 sign-up bonus

Gold as an investment has proven its worth time and again, especially in the Indian market. Understanding whether gold is a good investment requires looking at its unique benefits and considering the gold investment pros and cons.

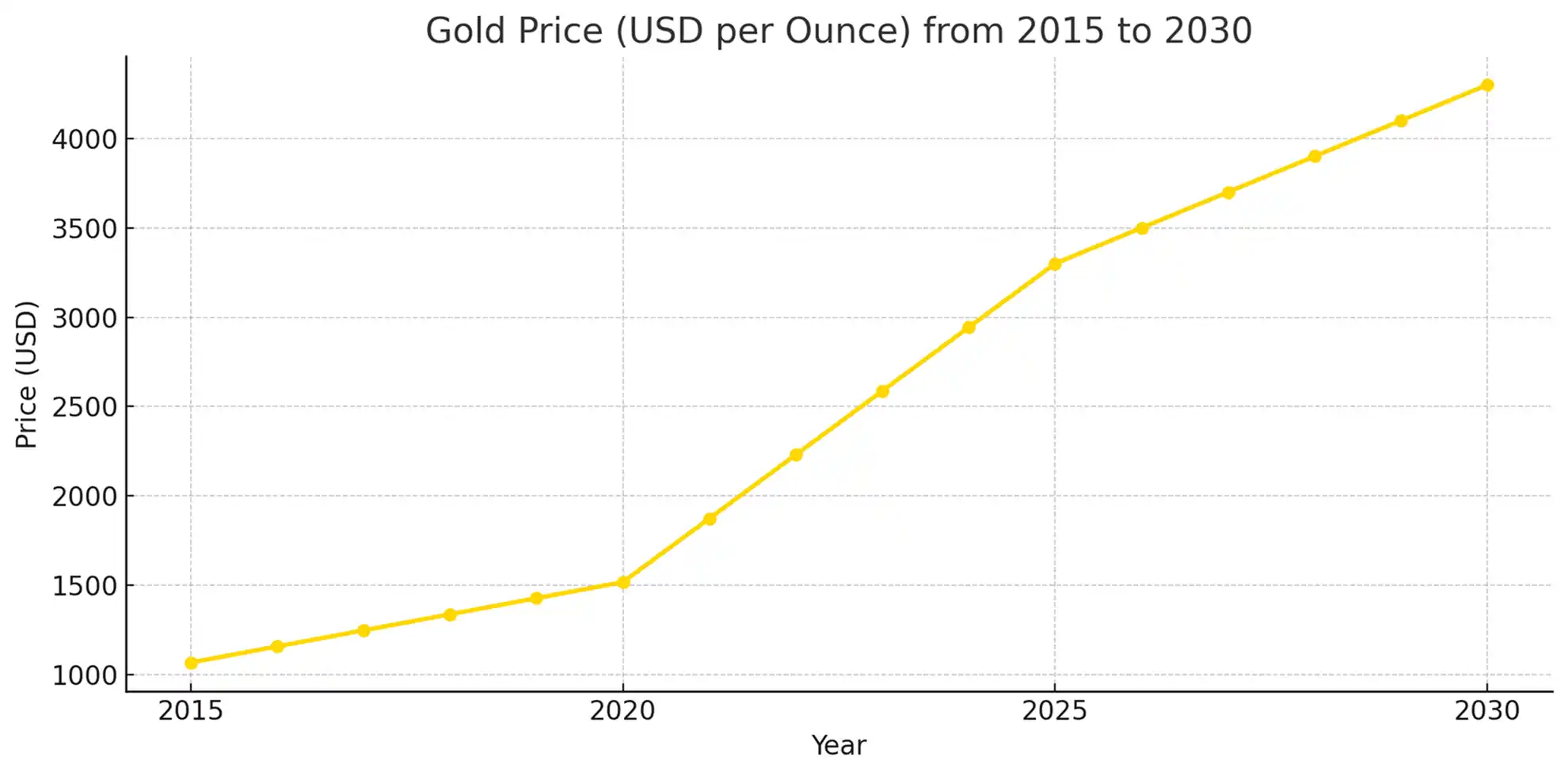

Gold investment in India has historically outperformed inflation. When the rupee weakens or stock markets crash, gold prices typically rise. During the 2008 financial crisis, while equity markets lost 50%, gold prices increased by 25% in India. This inverse relationship makes gold an excellent hedge against economic uncertainty.

Smart investors never put all eggs in one basket. Gold investment provides crucial diversification because it moves independently of stocks and bonds. Financial experts recommend allocating 10-15% of your portfolio to gold to reduce overall risk and improve long-term returns.

Over the past 20 years, gold has delivered average annual returns of 12-15% in India. During periods of high inflation like 2011-2013, gold prices surged from ₹18,000 to ₹32,000 per 10 grams, protecting investors' purchasing power.

Advantages

Disadvantages

Current Gold Price:

₹XXXXXX

Last checked: XX.XX.XXXX XX:XX

Yesterday’s Price:

₹ XXXXXX

24h Change:

X%

If you're wondering how to start gold investment or looking for the best way to invest in gold in India, this section will help you choose the right method based on your goals and budget.

Physical gold remains the most popular choice among Indian investors, offering a tangible and secure way to preserve wealth. Investors can buy gold bars, coins, or jewelry from certified dealers, banks, or government mints like MMTC-PAMP, ensuring authenticity and purity. Gold coins and bars typically have minimal making charges, making them more profitable for long-term investment, while jewelry often carries 8–25% making charges that reduce returns. Physical gold is highly liquid, widely recognized, and acts as a hedge against inflation, market volatility, and currency fluctuations. It is suitable for both new investors seeking portfolio diversification and experienced investors looking for stable returns. Buyers should compare prices across banks, online platforms, and local certified dealers, monitor gold rates, and consider storage and insurance options for safe keeping. Digital platforms also allow verification of gold authenticity, while festivals and bank promotions sometimes offer discounted rates for coins and bars, helping investors maximize returns. Selling physical gold is straightforward through banks or certified dealers, providing additional flexibility.

Key points:

Digital gold platforms like Paytm Gold, PhonePe Gold, Aditya Birla Digital Gold, Axis Bank Digital Gold, Safegold, and Groww allow you to invest in gold online in India starting from as little as ₹1. You can buy digital gold online, invest through digital gold SIPs, or trade gold ETFs (Exchange Traded Funds) on stock exchanges like NSE and BSE, giving paper gold exposure without physical storage concerns. Digital gold investment apps make it easy to track your holdings, calculate returns, and even gift digital gold to friends and family. Compared to SGBs or physical gold, digital gold offers instant liquidity, transparency, and minimal hassle.

Benefits:

Start investing in gold

Gold mutual funds in India are an ideal way to invest in gold without the hassle of physical storage. These funds invest in gold ETFs, gold mining companies, and other gold-related assets, offering professional portfolio management. You can start with a SIP (Systematic Investment Plan) as low as ₹500 per month, making gold investment accessible even for beginners. Popular gold mutual funds include HDFC Gold Fund, Kotak Gold ETF Fund, PGIM India Gold Fund, Edelweiss Gold Fund, and others. Investors can also compare these funds with digital gold and gold ETFs to choose the most suitable option for their portfolio. Investing via gold mutual funds allows you to benefit from gold price appreciation, tax-efficient LTCG after 3 years, and flexibility to increase SIP contributions over time. Whether you prefer gold SIP, gold ETF, or digital gold investment, mutual funds provide a convenient and low-risk option to grow your wealth.

Key advantages:

Sovereign Gold Bonds (SGBs) are government-backed securities that allow you to invest in gold without holding physical metal. These bonds offer a fixed 2.5% annual interest along with the potential for gold price appreciation. SGBs are one of the safest and most tax-efficient ways to invest in gold in India, making them ideal for both beginners and seasoned investors. You can buy SGBs online or offline through banks such as ICICI, Kotak, Canara Bank, Bank of Baroda, or via authorized brokers. With an 8-year maturity and the option of early redemption after 5 years, SGBs combine security, liquidity, and convenience. Many investors also compare digital gold vs SGB to choose the best method for their portfolio.

Key features:

Advanced investors can trade gold with leverage through XAUUSD (Gold vs US Dollar) and XAUTUSDT (Tether Gold vs USDT) pairs on crypto platforms like Bybit India. This approach offers higher potential returns but requires market knowledge, disciplined trading, and strict risk management. Trading gold online with leverage allows you to profit from both rising and falling prices while using lower capital compared to physical gold.

Key advantages:

XAUUSD trading has gained popularity among Indian investors seeking higher returns from gold price movements. While gold trading for beginners may seem complex, this comprehensive guide will walk you through everything from basic concepts to advanced strategies and risk management.

XAUUSD represents one troy ounce of gold priced in US dollars. Gold trading for beginners often starts with XAUUSD because it allows you to profit from both rising and falling gold prices through contracts for difference (CFDs). Unlike physical gold, you can trade 24/5 and use gold leverage trading to amplify returns.

XAUTUSDT works similarly but uses Tether (USDT) instead of USD, making it popular on cryptocurrency exchanges like Bybit.

Key features:

Choose a Platform:

Sign up on a trusted gold trading platform like Bybit, which is popular among Indian traders for its user-friendly interface and competitive fees.

Complete KYC:

Submit ID proof (Aadhaar card or Passport). This typically takes 3-48 hours.

Deposit Funds:

Start with as little as $10 (₹800) using UPI, bank transfer, or cryptocurrency. Bybit supports multiple deposit methods for Indian users.

Learn the Basics:

Use the demo account feature to practice gold trading for beginners without risking real money.

Start Trading:

Place buy or sell orders based on market analysis. Always use stop-loss orders to protect your capital and start with small position sizes (0.01 lots).

The XAUUSD market open time in India is 24 hours a day, 5 days a week — from Monday 3:30 AM IST to Saturday 3:30 AM IST, matching global forex hours.

Most international brokers accepting Indian clients require a minimum deposit of $10-100 (₹800-8,000). However, experts recommend starting with at least $100-$500 (₹8,000-40,000) to effectively manage risk and withstand market fluctuations.

Always invest only what you can afford to lose, especially when using leverage.

Is trading XAUUSD legal in India? Yes, Indian residents can trade XAUUSD via international platforms like Bybit.

Choosing the right gold trading platform is crucial for a smooth and secure experience. While many platforms offer gold-related investments, if you're looking into XAUUSD/XAUTUSDT, you need a platform that's reliable, user-friendly, and offers competitive fees.

When looking at the best gold trading platforms in India, Bybit has emerged as a strong contender, particularly for Indian traders interested in XAUUSD/XAUTUSDT and other crypto-related assets. Here’s why:

Read our full Bybit India review and claim your bonus

While gold investment for beginners offers numerous benefits, it's essential to be aware of the associated gold investment risks. This is especially true for leveraged trading instruments like XAUUSD/XAUTUSDT. Understanding these risks and implementing strategies to mitigate them is crucial for a successful investment journey.

Successful gold investors always prioritize risk management:

Yes, it is. XAUTUSDT (Tether Gold) is backed by physical gold reserves, making it relatively safer than pure cryptocurrency. However, it still carries platform and regulatory risk.

When considering minimum amount to invest in XAUUSD, start small and scale up gradually:

| Type | Amount |

|---|---|

| Demo trading | ₹0 (practice with virtual money) |

| Live micro-lots | ₹800-2,000 ($10-25) |

| Standard positions | ₹8,000-40,000 ($100-500) |

| Professional trading | Professional trading: ₹80,000+ ($1,000+) |

Is gold a good investment in 2025?

Yes, gold is a good investment in 2025 for Indian investors. It helps protect against inflation, adds portfolio stability, and historically performs well during market volatility.

How Much Should I Invest in Gold?

Start with 5–10% of your investment portfolio, based on your goals and risk tolerance. For XAUUSD/XAUTUSDT trading, ₹1,000–₹2,000 is enough to begin.

XAUT/USDT vs XAU/USD: Which Is Better?

XAU/USD is better for traditional forex traders due to regulation and tighter spreads. XAUT/USDT suits crypto users looking for gold-backed stablecoin exposure. Both are available on Bybit.

Is Online Gold Trading Safe?

Yes, online gold trading is safe when done on trusted platforms. Look for features like 2FA, fund encryption, and transparent terms. Always manage risk and avoid unknown brokers.

What Documents Are Needed for Trading?

Aadhaar Card or Passport to complete KYC (Know Your Customer) verification.

Gold has proven to be a resilient and valuable asset for Indian investors for centuries. Whether you prefer the tangible security of physical gold, the convenience of digital options, or the dynamic opportunities of leveraged trading, the Indian market offers a diverse range of choices to suit your investment style.